Hearing protection 101

Hearing protection is not a luxury accessory, it is an essential piece of kit for safeguarding your hearing for years to come.

Get information on the legal shooting season for mammals and birds in the UK.

Apply for funding for your project or make a donation today

Comprehensive information and advice from our specialist firearms team.

Everything you need to know about shotgun, rifle and airgun ammunition.

Find our up-to-date information, advice and links to government resources.

Everything you need to know on firearms law and licensing.

All the latest news and advice on general licences and how they affect you.

Are you up to speed on the changes that came into effect in 2025 for double and extended cab pickups?

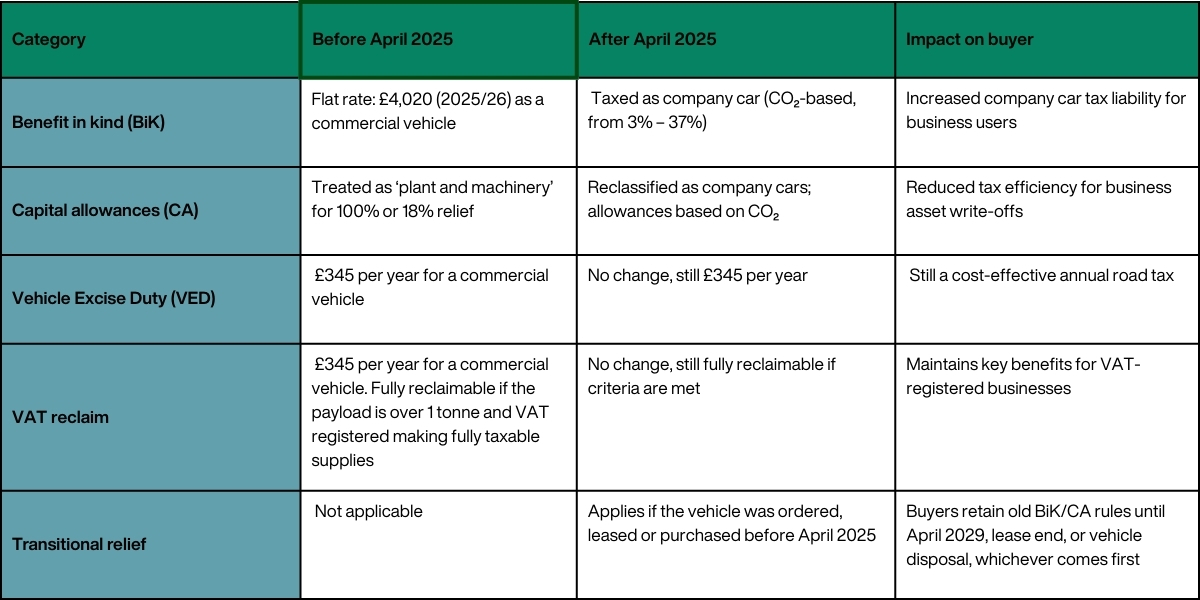

Since April 2025, double and extended cab pick-ups are now classed as company cars for benefit in kind (BiK) and capital allowance (CA) purposes. With ongoing confusion amid buyers, accountants and dealers, manufacturers are trying to help the industry navigate these changes with clear guidance and tools.

While BiK and CA legislation for double and extended cab pickups has shifted – classifying them as company cars for tax purposes – Vehicle Excise Duty (VED, also known as road tax) remains at the commercial level of £345 per year, offering continued affordability for business users.

Similarly, VAT remains fully reclaimable on all double and extended cab pick-ups with a payload exceeding one tonne, provided the purchasing business is VAT-registered making fully taxable supplies. These two core financial advantages provide essential ongoing support for businesses that rely on pickups for day-to-day operations.

As of 6 April 2025, newly registered double and extended cab pick-ups are now subject to company car BIK rates, which vary from three per cent to 37 per cent depending on CO₂ emissions. Zero-emission vehicles with payloads over one tonne begin at the lower end of this scale, with a three per cent rate increasing by one percentage point annually until 2028.

A transition period is in place for the changes. Pickups that were ordered, purchased, or leased before 6 April 2025 will retain their previous classification and benefit from the historic flat-rate commercial vehicle BIK treatment until disposal, lease expiry, or 5 April 2029.

CA rules also changed as of 1 April 2025 for corporation tax and 6 April for income tax. Double and extended cab pickups are no longer eligible for treatment as ‘plant and machinery’ and are now taxed in line with company car writing-down allowances, which are calculated based on CO₂ output. These rates can be six per cent, 18 per cent, or 100 per cent for zero-emission vehicles. It is important to note that expenditure must be incurred prior to 1 October 2025 to fall under the old regime.

The change in legislation originates from a Court of Appeal ruling, which found that double and extended cab pickups do not demonstrate a predominant suitability for transporting goods over passengers. As a result, HMRC has moved to classify these dual-purpose vehicles as cars for the purposes of BiK, CA, and deductions from business profits.

Industry feedback gathered has revealed widespread misunderstanding regarding the extent of these legislative changes. Manufacturer research and dealer insight show that over 71 per cent of pickup buyers, 68 per cent of accountants, and 59 cent of dealers are still uncertain about how the changes affect VED and VAT.

This has led to frequent and unnecessary concerns, especially among professionals in agriculture, construction, and

Hearing protection is not a luxury accessory, it is an essential piece of kit for safeguarding your hearing for years to come.